Agricultural Machinery Trade: Meeting the Challenges

The agricultural machinery dealer trade is facing numerous challenges—many of which it can only respond to in a limited way. One major challenge is digitalization, which continues to make rapid progress on farms. This development demands that dealers provide solutions and expertise that farmers increasingly expect so that they can meet the demands of the future. Agritechnica 2025 will showcase a wide range of new developments that demonstrate the opportunities agricultural machinery dealers can offer farms.

Geopolitical crises, market volatility, high interest rates, unclear policy frameworks, and growing uncertainty regarding yields and crop quality due to extreme weather events all weigh heavily on farming operations. Depending on farm type, these factors can have varying impacts on income and willingness to invest.

In 2024, various factors contributed to a noticeable reluctance to buy among farmers—an unfortunate development for the machinery trade. Many dealers today still have full inventories of new machines ordered during the COVID-19 period, when concerns about supply chain disruptions led to early purchases.

Extreme weather adds pressure

In 2024, extreme weather again posed major challenges for crop producers. Unlike in 2023, when drought dominated, this time flooding and untimely rainfall resulted in reduced yields. Winter wheat was particularly affected. In some regions, heavy autumn rainfall delayed or even prevented sowing. Potato growers faced similar problems, which impacted both the quantity and quality of the harvest.

High interest rates deter investment

Another factor in dampened investment activity is the ongoing high-interest environment resulting from central bank policy. Farming is one of the most capital-intensive sectors. According to the 2024/25 Situational Report from the German Farmers’ Association (DBV), only about one-third of farm and forestry assets in Germany are financed by debt. Still, increased interest rates raise the cost of operating machinery. Financing a tractor today through Landwirtschaftliche Rentenbank costs about 2.5 percentage points more than it did during the low-rate environment of 2022.

Agricultural policy uncertainty

Uncertainty in agricultural policy is another brake on investment. According to the DBV, many farmers viewed the agricultural policy of the previous federal government as a key reason for their reluctance to invest. While farm operators have become more adept at handling market fluctuations, they demand planning certainty when it comes to investment decisions. It remains to be seen whether the new government can provide greater predictability through long-term legislative frameworks.

Digitalization as a direct challenge

While external factors are difficult for machinery dealers to influence—beyond offering attractive financing or sales terms—the challenge of digitalization is different. Here, the trade is directly called upon. Digital technologies already play a central role in agriculture and will continue to grow in importance. Success for dealers increasingly depends on their competence, technical know-how, and the digital services they can provide.

Technologies such as GPS steering systems and automated harvesting tools are now standard across the country. Farmers use them to boost efficiency, improve sustainability, and reduce workloads. These systems help them meet rising demands for precision and productivity.

A complex matter

Dealers must incorporate these digital technologies into their portfolios—if they haven’t already—and offer suitable products to their customers. However, this is often easier said than done, as the technology is complex and requires significant advisory support. On top of that, rapid innovation cycles in machines, systems, and software mean that dealers must stay constantly up to date.

Sales and service staff are also increasingly faced with highly tech-savvy customers who are well-versed in sensors and software. A tractor may sell itself on emotional appeal, but digital solutions often lack that charm and can be harder to grasp. This makes consultations more demanding. The digital needs of a large arable farm, for example, may be far more advanced than those of a grassland operation.

Compatibility questions about different digital systems frequently arise and can overwhelm sales staff without proper knowledge. To meet these expectations, dealership personnel must be thoroughly trained in integrated digital solutions and able to communicate their benefits convincingly. When product performance and system integration align, successful sales are far more likely.

Slight Increase in willingness to invest

These are the current challenges the agricultural machinery trade is facing. Many dealers are hopeful that German farmers will show a greater willingness to invest in 2025. There is cause for optimism. According to the latest agricultural barometer from Landwirtschaftliche Rentenbank, the business climate has improved since fall 2024. The survey shows that 64 percent of farmers are planning to invest this year.

The Rentenbank notes that investments are critical for securing the future of agriculture. With drivers like climate change, digitalization, and demographic shifts, the industry understands that only through major investments can it position itself for sustainable and competitive growth.

Agritechnica 2025: Platform for international agricultural machinery trade

Agritechnica 2025 provides farmers with a prime opportunity to visit manufacturer stands together with their machinery dealers to explore the latest technologies for their operations. While many of these will be digital solutions, farms are also seeking answers in crop protection, soil conservation, and water-efficient practices. They need tailored, effective tools for a wide range of operational challenges.

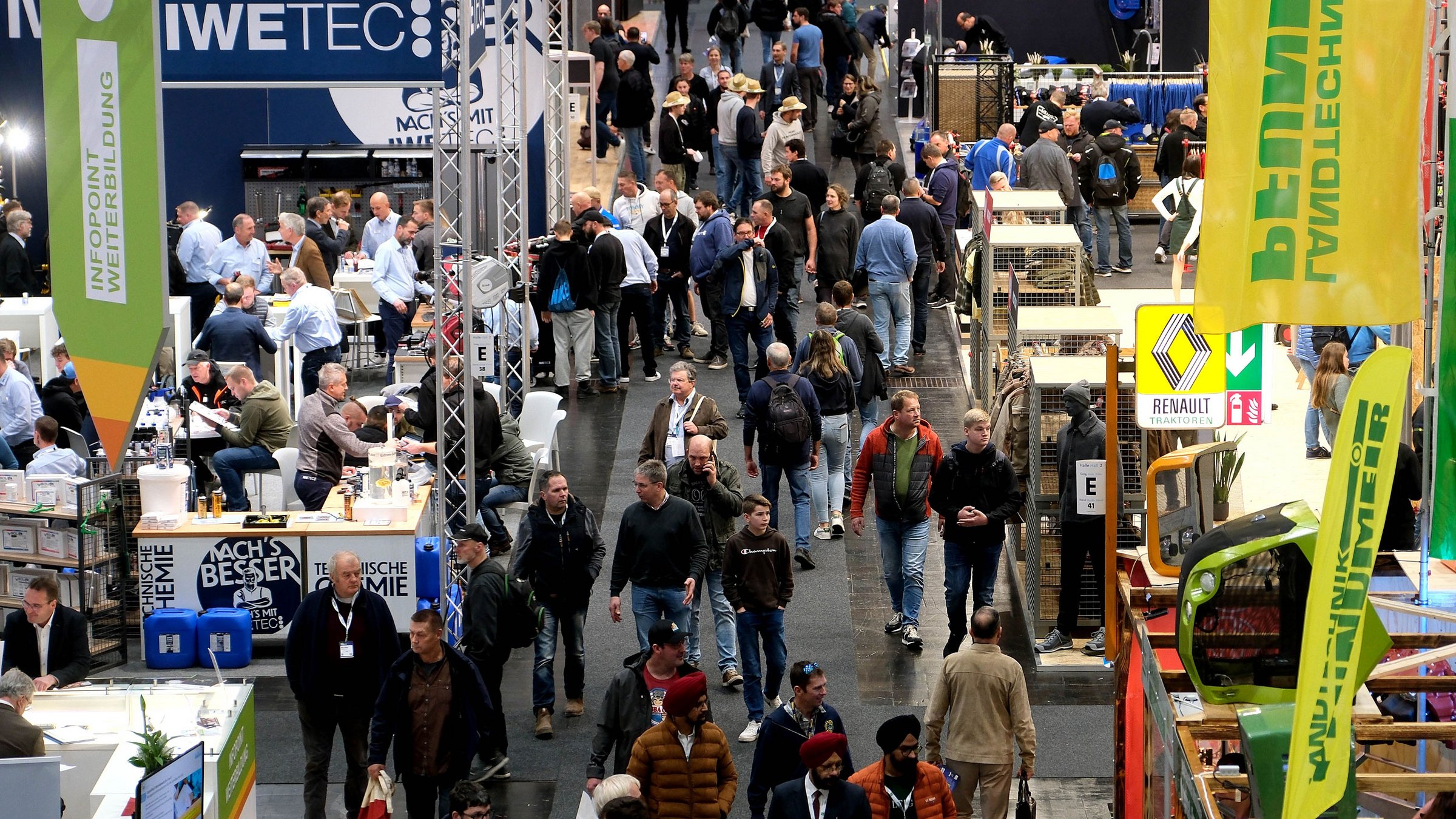

As the world’s leading trade fair for agricultural machinery, Agritechnica is the ideal venue for both farmers and dealers to gain a comprehensive overview of current technology and trends in the global agriculture sector. It brings together manufacturers, dealers, farmers, and industry experts from around the world—facilitating international networking and exchange.

In 2025, the show introduces innovative new formats to further enhance visibility and connectivity—creating added value for the agricultural machinery trade. Key among these is the International Dealer Center (IDC), the central hub for the global dealership community. Here, visitors will find an exclusive lounge for dealers, business partners, customers, and employees; daily “Pop-up Talk Dealer” sessions at 5 p.m. featuring international speakers; informal networking events; and an information counter on education and training in the sector.

Also new is the “Business Matchmaking” program, which enables targeted business connections between dealers and exhibitors—helping forge valuable new relationships.

The proven “Workshop Live”returns with an upgradedVersion 2.0as part of the new Agribusiness Days. This year's focus includes key service areas such as robotics, artificial intelligence, and precision farming. The aim is to attract new talent and promote the career of agricultural and construction machinery technicians.